/

GST Input Tax GL VS GST-03 6b.

GST Input Tax GL VS GST-03 6b.

- Please refer to the excel sheet template for the data comparison.

| Month | (A) GST Input Ledger Balance | (B) GST journal transfer to gst_Payable | (C) GST-03 Form 6b. | (D) GST Input ledger without BL : (A) - (B)BL | Diff between (D) - (B) | Diff between (B) - (C) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Debit / Credit | Amount | Tax Code | Date | Jtxn | Amount | Total Amount | Amount | ||||

| TX | |||||||||||

| BL | |||||||||||

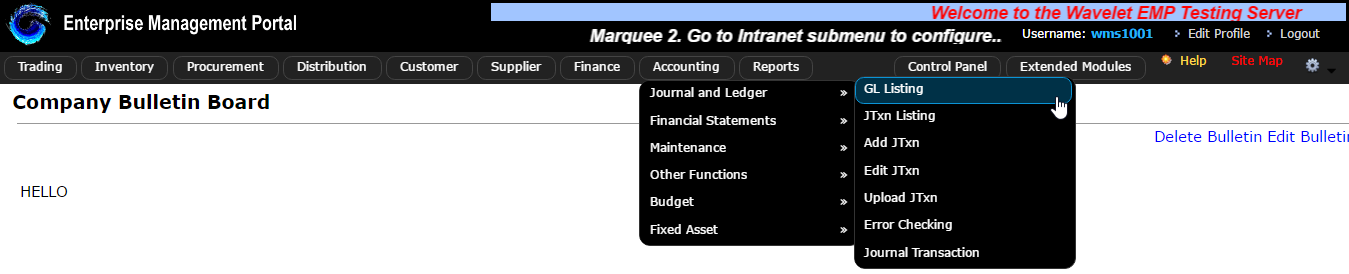

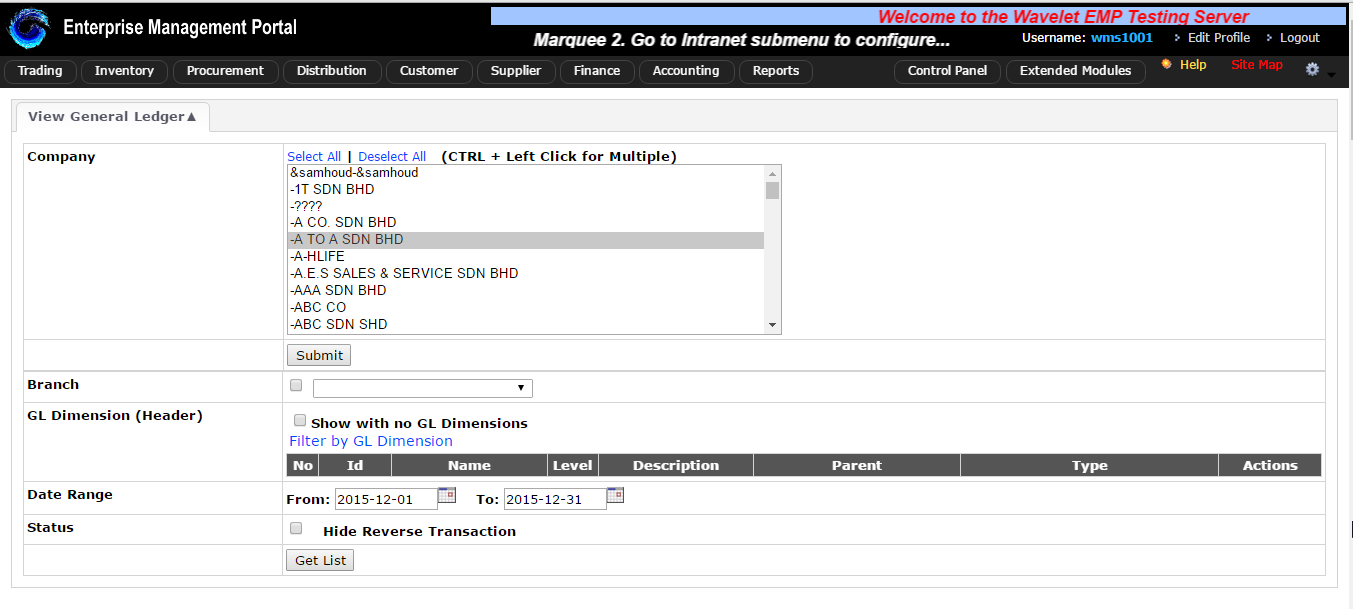

(A) To get the data, go to : Accounting > Journal and Ledger > GL Listing.

- Select the company, date range & get list.

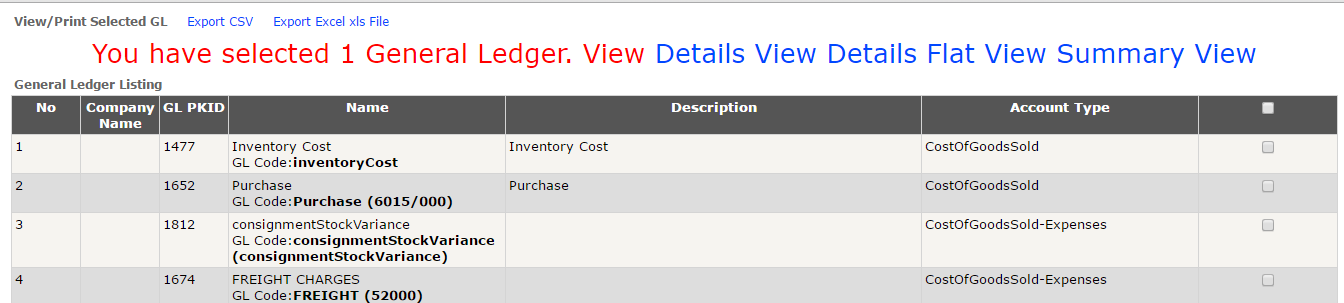

- Choose for glcode : gst_Input.

- Click Detail View

(B) Get the journal from acc_Payble glcode, same step as (A)

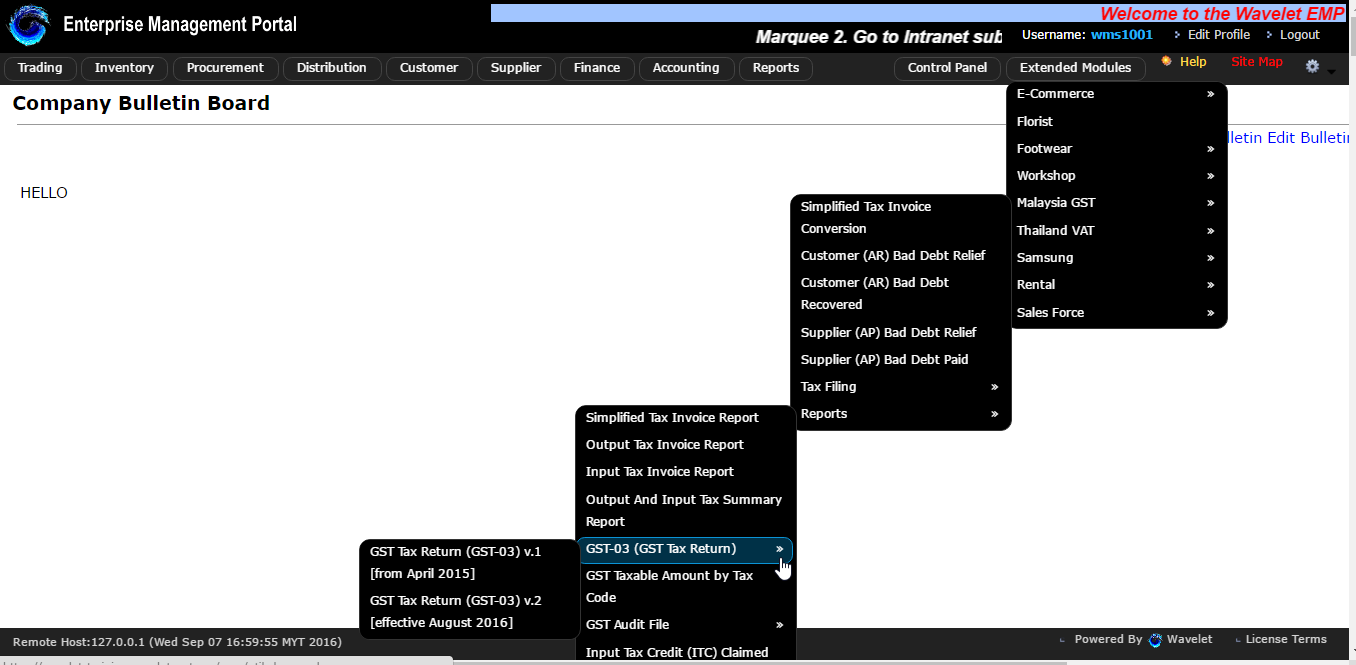

Note: to check the BL tax code Input tax detail, can refer to Extended Module > Malaysia GST > Reports > Input Tax Invoice Report > refer to BL column.

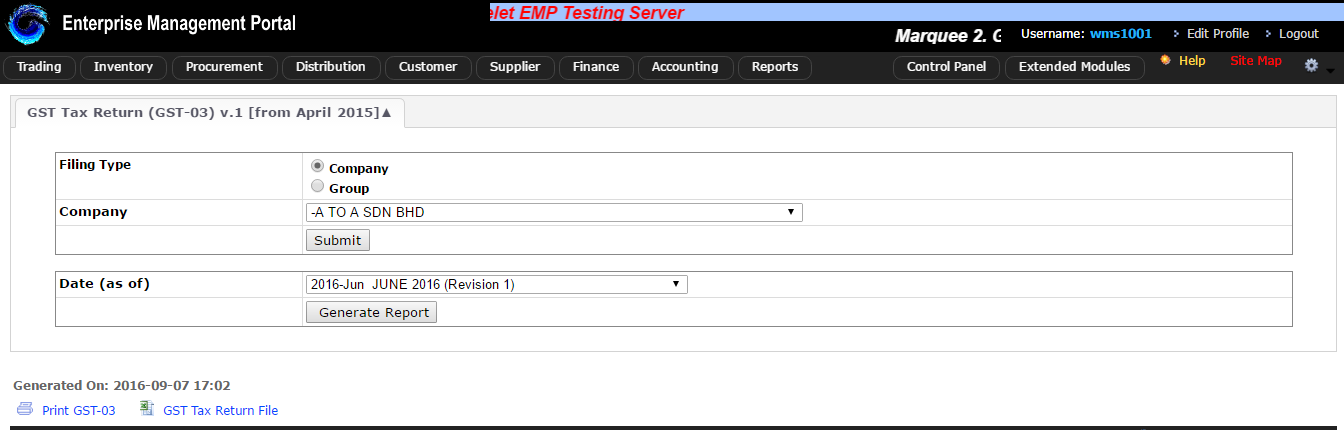

(C) To get the data, go to : Extended Module > Malaysia GST > GST Reports > GST-03 (GST Tax Return)

- Select the company,date & generate report.

Private & Confidential